Singapore’s healthcare system is among the most advanced in Asia, but quality medical services come at a cost. That’s why securing personal health insurance in Singapore is essential to safeguard your financial future.

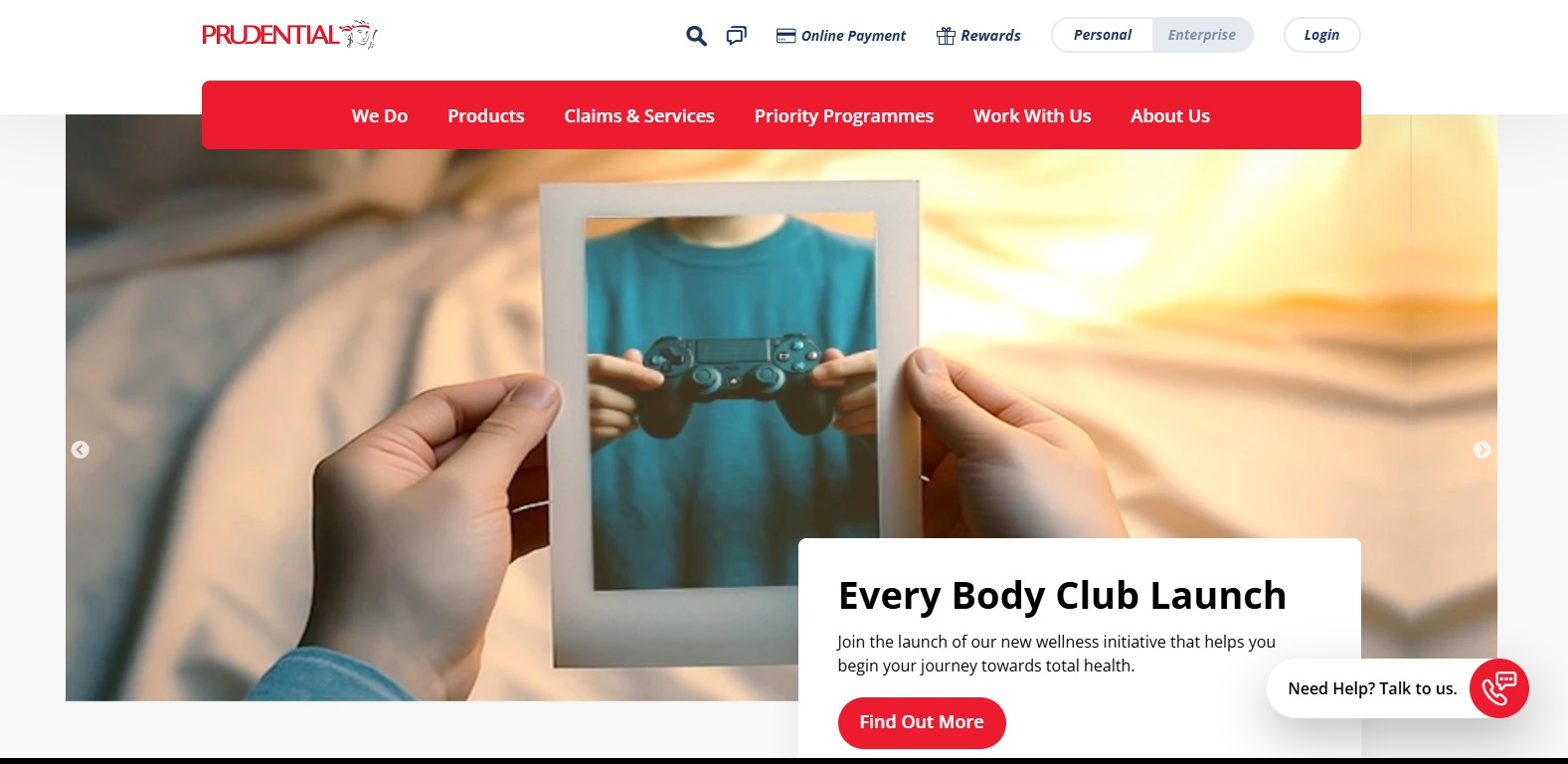

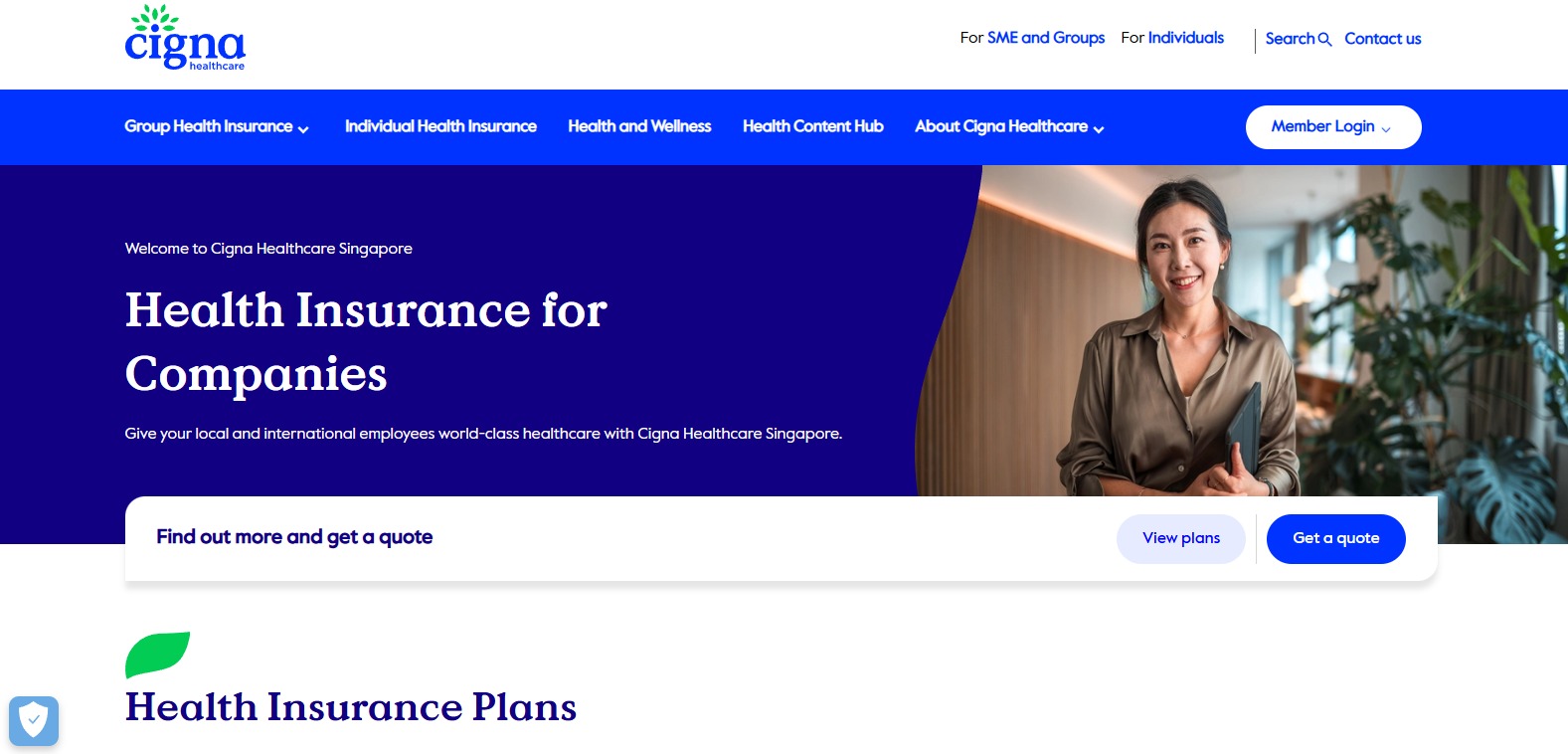

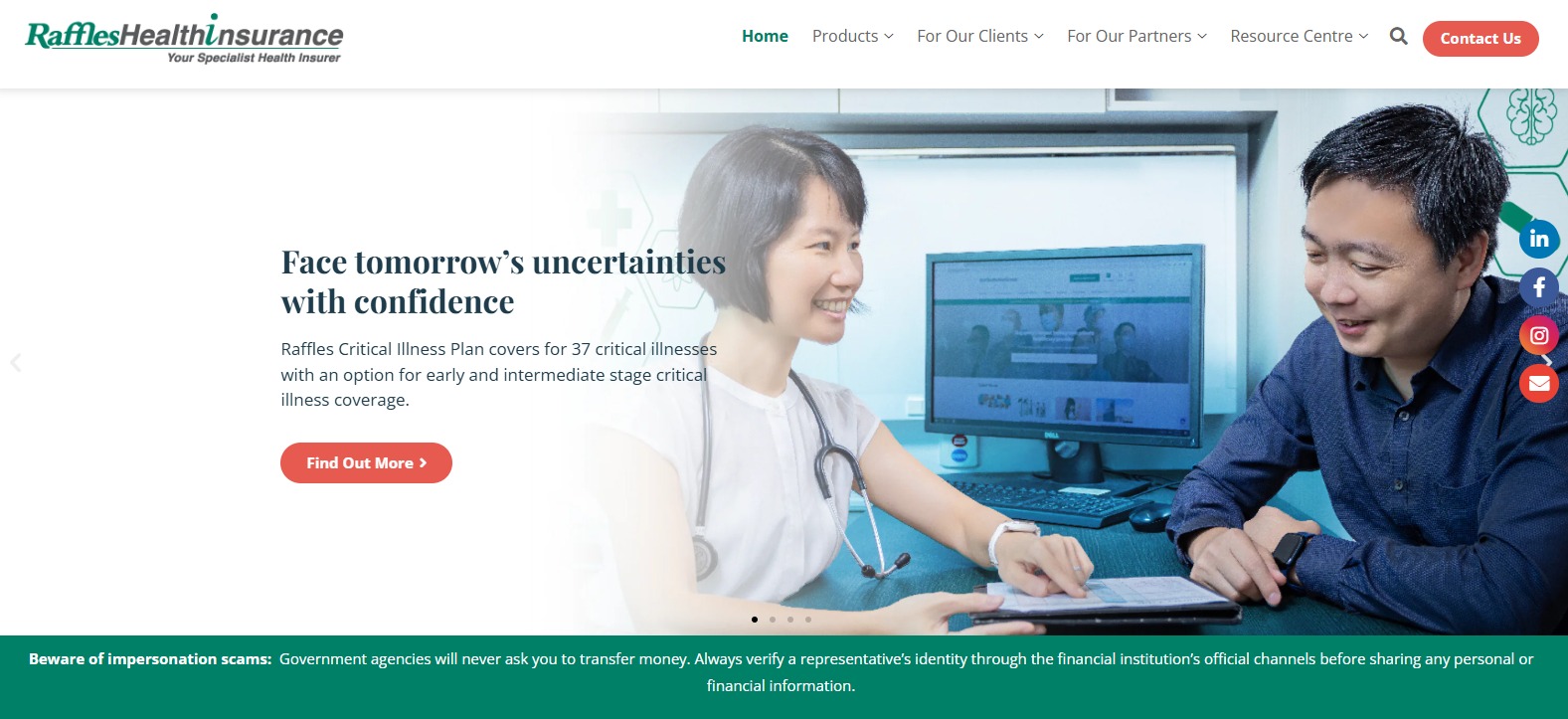

Whether you’re an individual, a couple, or planning for your children, exploring the right family insurance Singapore provider can help ensure peace of mind. From digital-first insurers to century-old institutions, this guide will walk you through the top 8 companies to consider when looking to buy health insurance in Singapore.

These providers offer a variety of insurance plans in Singapore tailored to both locals and expats, whether for routine care or unexpected medical emergencies. Here’s where to begin your search for reliable and affordable health insurance plans in Singapore.

Conclusion

Choosing the best health insurance plans in Singapore isn’t just about finding the lowest premiums, as it’s about balancing coverage, service quality, and future flexibility. Whether you’re comparing insurance coverage in Singapore as a working professional or browsing family insurance Singapore options for your household, it pays to do the research. These eight trusted providers stand out for their innovation, support systems, and commitment to wellness. Take advantage of their digital tools and expert consultation services to customise your health insurance plan. Investing in the right insurance plans in Singapore today could be the most valuable decision for your health and financial well-being tomorrow. Explore the options listed above to buy health insurance in Singapore confidently and comprehensively.